For years, MicroStrategy shareholders have outperformed bitcoin. A $100 funding in every three years in the past would right now yield $450 and $140, respectively. Stretch that again 4 years and the figures widen additional: $2,700 to MicroStrategy versus for $550 bitcoin.

With so a few years of outperformance within the bag, buyers at the moment are wanting forward. However, will MicroStrategy CEO Michael Saylor be capable of lengthen his run?

Though buyers worth the corporate nearly completely on its bitcoin holdings, its distinctive capacity to faucet debt markets has attracted the next charge of capital than a easy match of its bitcoin acquisitions. Reasonably than monitoring the worth of bitcoin, the corporate is curiously increasing at a a number of of its bitcoin holdings.

As of Friday’s shut of buying and selling on Wall Avenue, MicroStrategy’s market cap (NASDAQ:MSTR) was $71.8 billion — a 2.89 a number of on its then-$24.8 billion value of bitcoin holdings.

Curiously, MicroStrategy is increasing at a a number of of its bitcoin holdings.

Once more, as a result of the enterprise has little worth except for its bitcoin holdings — it has generated unfavourable earnings and fewer than $600 million in annual income for the final three years — valuing the corporate primarily based on its a number of is rational.

At a 1X a number of, the market cap of MSTR would equal its bitcoin holdings. These days, its a number of is clearly increasing.

In fact, MicroStrategy has not all the time traded at a premium to its property. For instance, on October 19, 2020, its market cap was $154 million but it surely held $440 million value of bitcoin. Its asset a number of on that date was simply 0.35 resulting from considerations about its capacity to repay money owed.

That negativity pale by 2021, nevertheless, as its a number of rallied for years to Friday’s 2.89. Some buyers consider that determine will proceed to develop.

‘Multiple expansion’ invitations hyper bullish forecasts

Impressed by MicroStrategy’s levitating a number of on bitcoin holdings, bullish estimates from individuals like Ben Werkman, Dylan LeClair, and plenty of others rained in. In line with assorted merchants on social media, MSTR may rally from its present inventory value of $340 to $2,300, $5,000, $6,000, $8,000, $13,000, and even $35,000.

In line with an analyst at Benchmark, Saylor will increase the corporate‘s a number of far above 2.89 through a “flywheel through which it uses a combination of low-cost debt and equity dilution” to extend bitcoin holdings per MSTR share.

Certainly, MicroStrategy has not solely outperformed bitcoin itself however has accreted bitcoin holdings per share since 2021. Even after adjusting for dilution, every MSTR share has accreted bitcoin publicity yearly for 3 years.

Utilizing MicroStrategy’s inner metric, its so-called assumed diluted shares excellent, executives boasted that every share of MSTR — even after sure changes for dilutive share and debt choices — gained 1.8% bitcoin publicity in 2022, 7.3% in 2023, and over 16% through the first three quarters of 2024.

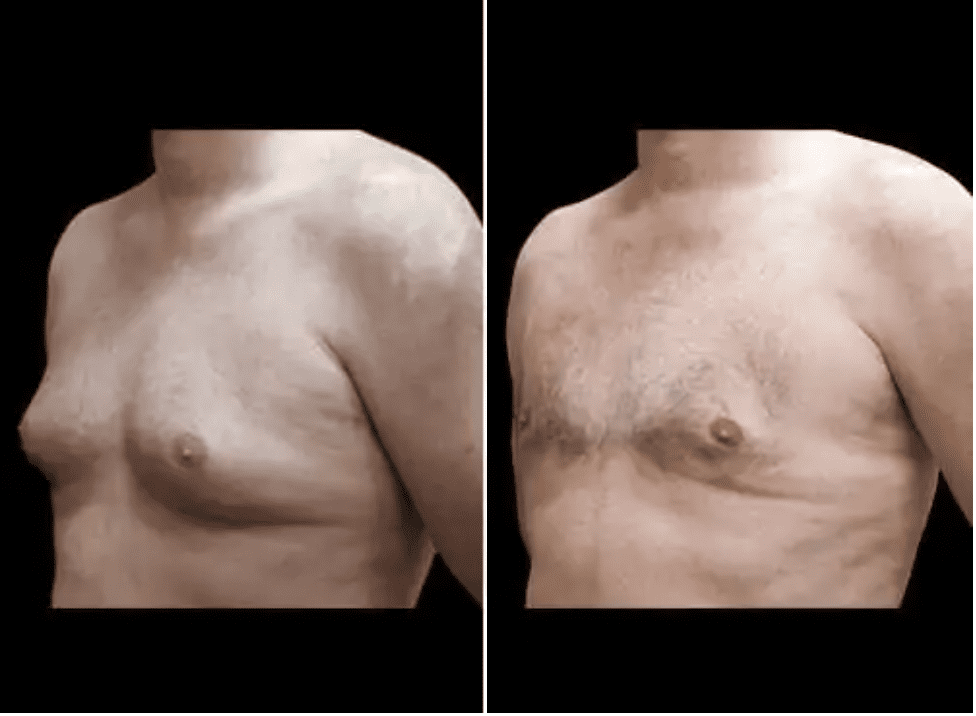

Picture courtesy MicroStrategy.

Picture courtesy MicroStrategy.

Someway, by including debt and diluting shares to seize a few of its increasing a number of, executives have added bitcoin holdings on a per-share foundation for greater than three years.

Studying the positive print on MicroStrategy’s bitcoin yield

Nonetheless, the formal definition of assumed diluted shares excellent tempers a few of these spectacular percentages. Buried in positive print within the Appendix of its Q3 2024 report, the corporate defines this time period — on which it builds its unimaginable 1.8%, 7.3%, and 16%-and-counting annual accretions — in a means that ought to sober some extrapolations of those figures.

MicroStrategy defines assumed diluted shares excellent as widespread inventory excellent “as of the end of each period plus all additional shares that would result from the assumed conversion of all outstanding convertible notes, exercise of all outstanding stock option awards, and settlement of all outstanding restricted stock units and performance stock units.”

“Outstanding” is a monetary time period meaning “currently issued and held by shareholders.” Importantly, this excludes notes, choices, and items that aren’t held by shareholders as of the tip of every reporting interval.

In different phrases, this definition makes it clear that MicroStrategy’s bitcoin accretions per share confer with historic snapshots and subsequently exclude the complete dilution inclusive of the corporate’s future obligations. MicroStrategy’s future obligations are appreciable.

Most of its debt choices are 4 years lengthy with a serious occasion at expiration corresponding to a warrant, possibility, or different convertible proper.

MicroStrategy admits its ‘yield’ shouldn’t be all the things it appears

After adjusting for these future obligations, these impressive-looking 1.8%, 7.3%, and 16%-and-counting annual percentages of bitcoin accretion will develop into much more muted. MicroStrategy even acknowledges this within the positive print of its Appendix to its third quarter monetary report.

“Such offerings have had the effect of increasing the BTC Yield without taking into account the corresponding debt,” it reads.

“Conversely, if any of our convertible senior notes mature or are redeemed with out being transformed into widespread inventory, we could also be required to promote shares in portions higher than the shares such notes are convertible into or generate money proceeds from the sale of bitcoin, both of which might have the impact of lowering the BTC Yield resulting from adjustments in our bitcoin holdings and shares in ways in which weren’t contemplated by the assumptions in calculating BTC Yield.

“Accordingly, this metric might overstate or understate the accretive nature of our use of equity capital to buy bitcoin.”

Ultimately, buyers’ perception in MicroStrategy’s long-term capacity to accrete bitcoin per MSTR share has some historic foundation but additionally depends on religion.

Three years may look like loads of knowledge, however after contemplating that almost all of its company debt is 4 years in size with a serious convertible occasion at expiry, it may not be sufficient knowledge to make an entire choice.

Whether or not the corporate will capable of increase its bitcoin a number of, leverage extra favorable debt sooner or later, or discover different avenues for accreting dilution-adjusted bitcoin holdings per share stays to be seen.