Cryptocurrency corporations have been dashing to challenge preliminary public choices (IPO) this 12 months; nevertheless, they’ve not all been winners for traders who get in when these shares are lastly provided publicly.

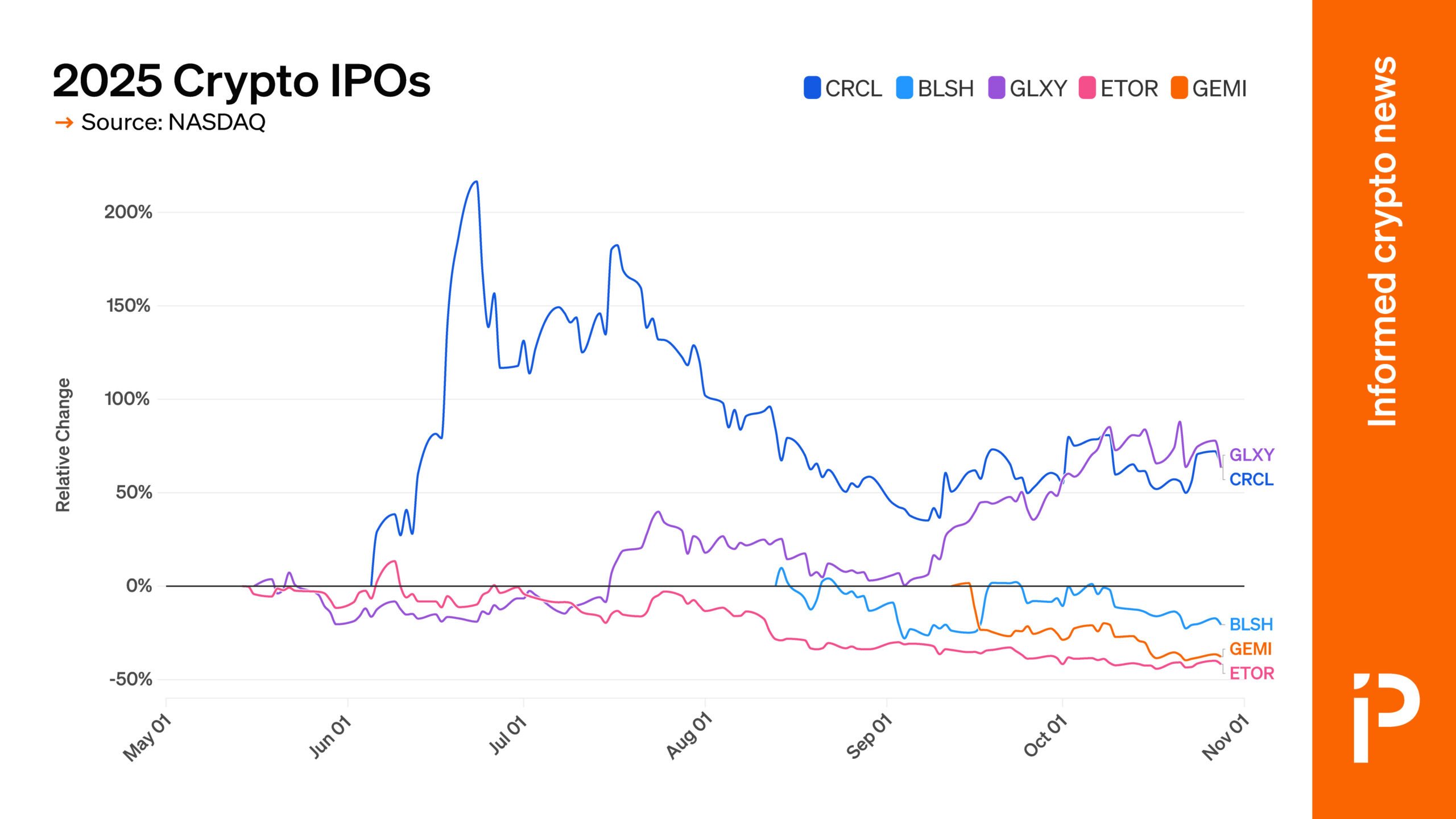

Amongst 5 corporations analyzed by Protos — Circle, Galaxy Digital, Bullish, Gemini, and eToro — solely two of them — Circle and Galaxy Digital — at present commerce above their preliminary value.

Galaxy Digital was additionally not technically an IPO, because it had beforehand traded on the Toronto Inventory Change, but it surely did supply an underwritten public providing of its inventory as a part of its itemizing on the NASDAQ change.

Galaxy Digital and Circle have each seen an approximate 63.5% relative enhance of their buying and selling value since their securities turned out there on NASDAQ.

Circle was, at one level, buying and selling at roughly 3 times its preliminary value earlier than falling to this decrease stage.

The three losers have all misplaced a minimum of 20%, with Bullish being the smallest relative drop.

The most important relative drop was eToro (which isn’t purely a crypto firm however does supply crypto merchandise) which has misplaced over 40% of its worth.

If an investor had hypothetically been in a position to put $1,000 into every of those corporations at their IPO their $5,000 funding would now be price roughly $5,260.