Digital Asset Treasury (DAT) corporations like TRON Inc. and Technique (previously MicroStrategy) have grow to be more and more well-liked, however regardless of that reality, a lot of them have appeared to battle.

Technique, remains to be buying bitcoin (BTC), including an extra 10,624 cash and bringing its whole to over 660,000.

Regardless of this persevering with acquisition of BTC, the corporate has seen its inventory worth lower, and its multiple-to-net asset worth (mNAV) fall.

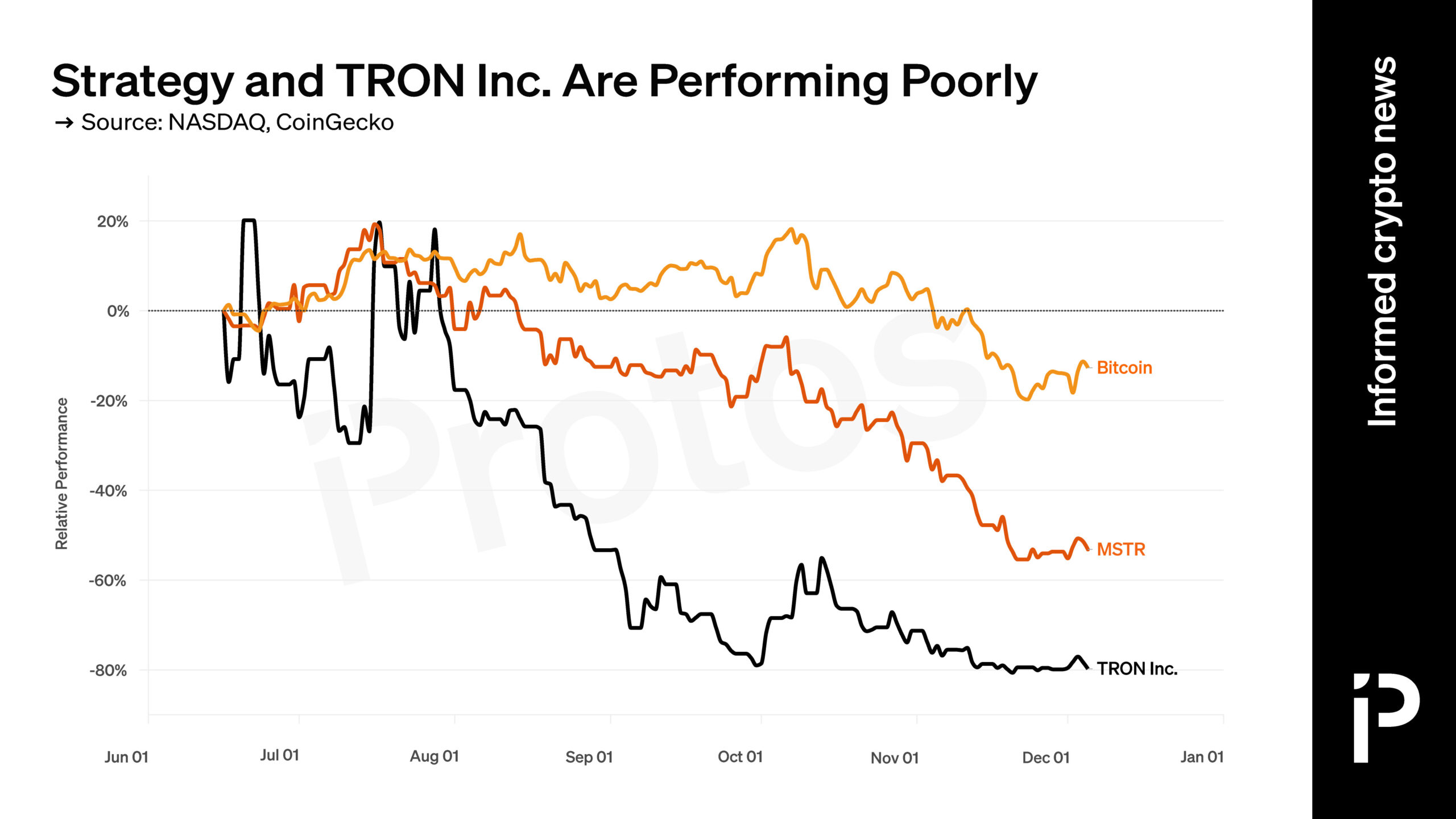

This sample has continued since June 13 when TRON Inc. was shaped, and its inventory value for its MSTR safety has dropped by roughly 53%.

TRON Inc., previously SRM Leisure, is a treasury agency that holds the TRX token, and is run by Weike Solar, the daddy of Justin Solar.

Justin is the founding father of the TRON protocol and, in response to Bloomberg, owns the vast majority of the TRX token related to it.

TRON Inc. reached a peak worth of roughly $11.04 shortly after its reverse merger and now trades for simply $1.83.

Total, it has shed roughly 80% of its worth because the reverse merger and pivot to DAT was introduced.

Each of those have shed worth considerably quicker than BTC, the historic crypto bellwether, which has misplaced simply 13% of its worth over this time interval.

This implies that traders have misplaced a few of their enthusiasm for these unusually structured corporations.