Technique, the world’s largest bitcoin (BTC) treasury firm, is including cash at its slowest price in 5 years.

To this point this quarter, the agency has added simply 388 cash to the 640,031 it held on the finish of Q3 — progress of simply 0.1%.

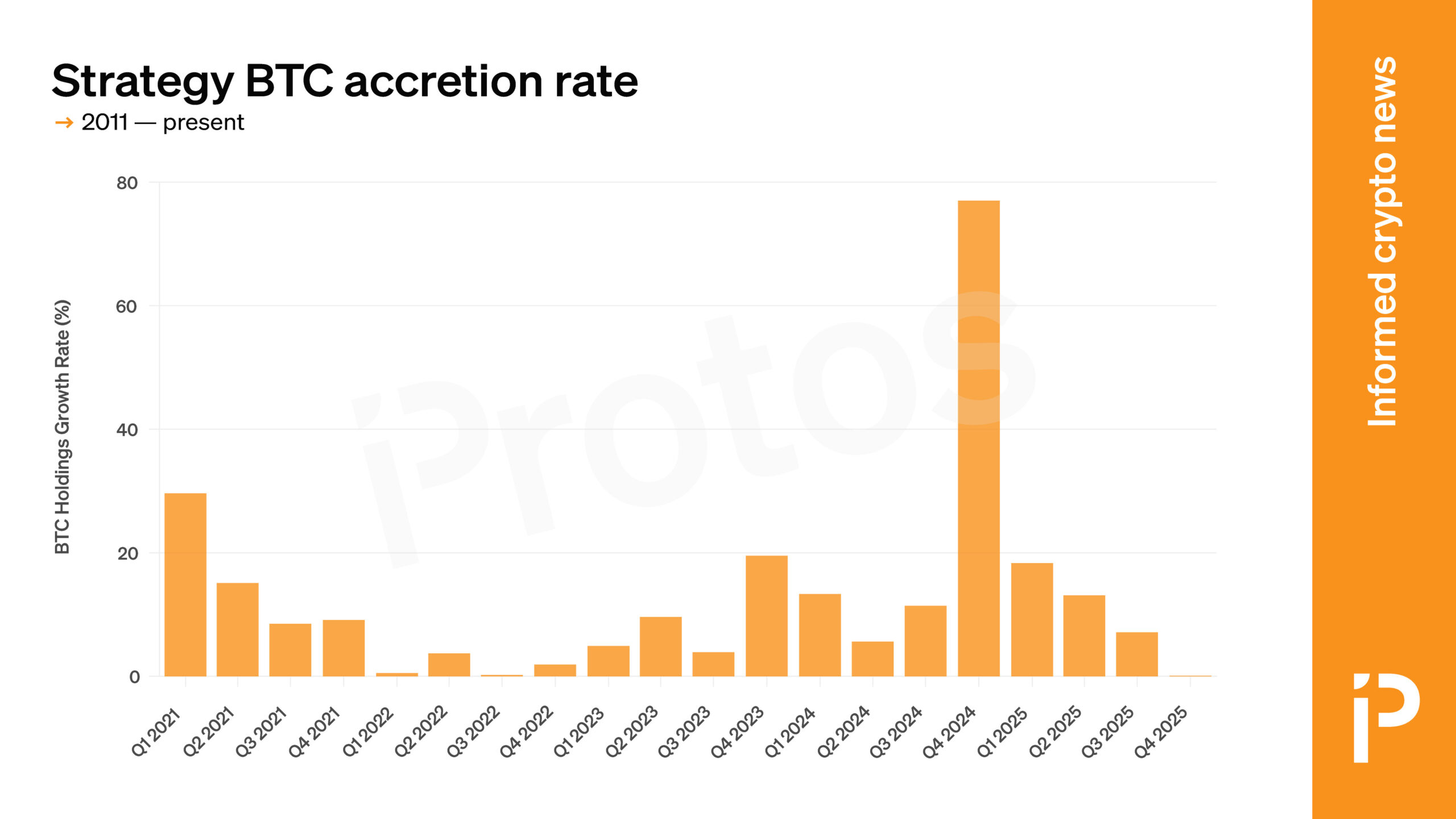

In earlier quarters, Technique has grown its treasury by excessive single and even excessive double-digit percentages. Certainly, in This autumn 2024, its BTC holdings progress hit a multi-year excessive of 77%.

Sadly, the value of Technique’s MSTR widespread inventory has additionally declined 10% this quarter alongside its dwindling purchases of BTC.

In 2020, Michael Saylor’s Nineteen Nineties enterprise software program firm pivoted into leveraged BTC purchases and, from a small base, the corporate had amassed 70,470 BTC by the tip of that yr.

Development in its BTC treasury continued at sturdy, double and excessive single-digital percentages all through 2021, slowed in 2022, after which picked up once more in 2023 and 2024.

By This autumn of 2024, as the value of BTC was rallying amid Donald Trump’s profitable presidential marketing campaign, BTC holdings progress peaked at 77%. The corporate has but to regain that prime.

The 4 quarters of 2025 have stepped-down BTC progress to a multi-year low: 18.3% in Q1, 13.1% in Q2, 7.1% in Q3, and simply 0.1% in This autumn up to now.

Worse, the premium that traders are inserting on the corporate’s ongoing potential to accrete BTC per share on a dilution-adjusted foundation has additionally been declining since This autumn.

After hitting a peak above 3.2x multiple-to-Internet Asset Worth (mNAV), the corporate’s fundamental mNAV right now is simply 1.2x.

Fundamental mNAV divides the corporate’s market capitalization by its BTC holdings. A not too long ago launched enterprise Worth mNAV provides debt and different assumptions to spice up the determine barely to 1.4x.

Utilizing both multiplier, MSTR’s mNAV has greater than halved since is This autumn 2024 peak. Over the identical time interval, its BTC progress price has declined greater than 99%.

Technique trying overseas for BTC progress

On varied interviews, Saylor has forecasted confidence that the corporate will be capable of create credit score merchandise and different sorts of monetary derivatives to cater to bond and glued earnings traders world wide.

He’s significantly optimistic about his 10.25% yielding most popular share STRC which is meant to commerce close to a $100 quasi-peg and serve the pursuits of high-yield bond merchants or subtle mounted earnings traders.

Saylor has additionally talked about the potential for STRC-type choices for euro, Japanese yen, British pound, or Canadian greenback traders.

“In essence, everybody in the world would love to have a high yield bank account that yielded 10% or more,” Saylor instructed Bloomberg in reference to STRC.

He added, “or they’d love to have a money market that gave them double or triple their normal money market.”

Sadly, that unbelievable plan hasn’t but materialized into BTC accretion inside This autumn 2025. For now, progress on the firm’s treasury stays at multi-year lows.