Donald Trump’s administration has made its assist for stablecoins express, and the 2 largest, USDC issued by Circle and USDT issued by Tether, have seen their market capitalizations enhance.

In absolute phrases, USDT has seen a bigger enhance, rising from roughly $138 billion to round $183 billion. This compares favorably to USDC, which has grown from roughly $48 billion to $76 billion.

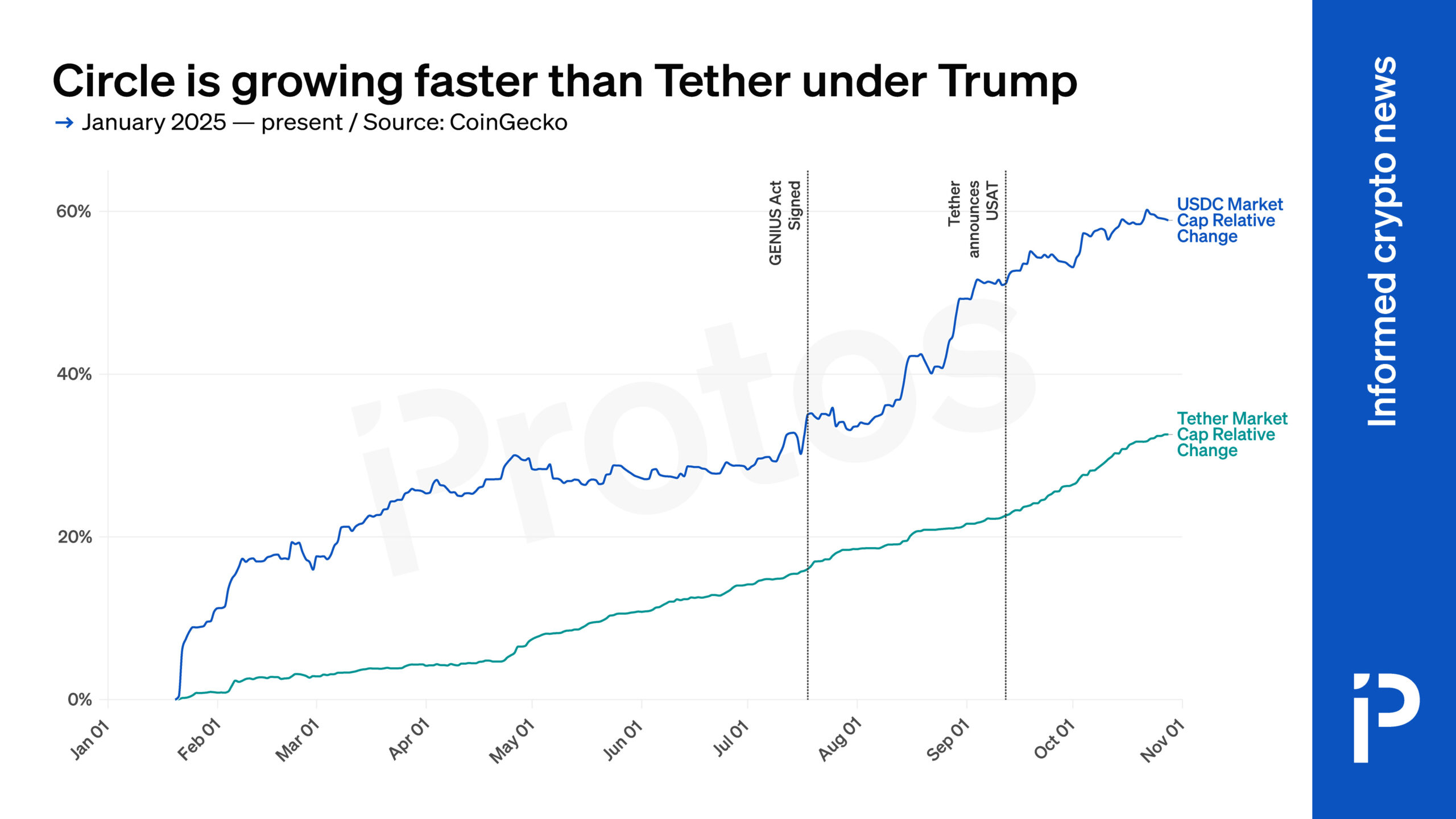

Nevertheless, if we as an alternative examine their relative enhance, USDC takes a big lead.

Certainly, once we make that comparability, we see that USDC has grown its market capitalization by roughly 59% throughout this second Trump administration. That is far more than USDT’s 32.5%.

Trump’s administration signed a brand new stablecoin regulation invoice — the GENIUS Act — into legislation throughout this time period. It’s meant to restrict the power for offshore stablecoin issuers like Tether, which is headquartered in El Salvador, to do enterprise in the US.

Circle appeared poised to learn from these limitations because it was based mostly inside the US.

Since then, Tether has introduced that it intends to launch a US-based model of its stablecoin, which will likely be led by Bo Hines.

Hines served as the chief director of Trump’s Council of Advisers on Digital Belongings earlier than leaving the administration and accepting this new function with Tether.

Moreover, Tether primarily depends on Cantor Fitzgerald because the custodian for its reserves, a agency that was based by Trump’s commerce secretary, Howard Lutnick.

Tether can be an necessary donor for the current destruction of the White Home East Wing and the promised building of Trump’s new ballroom. Coinbase, which owns a considerable stake in Circle, can be a donor to this mission.