In accordance with The Monetary Occasions, China is eyeing a yuan (aka renminbi) stablecoin for each inner and exterior use, however as even The Monetary Occasions article makes clear, nobody is aware of how it might work or why the Chinese language Communist Get together (CCP) is so eager to create one.

Whereas the piece does clarify that the CCP is “arguing that the success of dollar-backed tokens is cementing the US currency’s dominance in the global economy,” it fails to determine how a tightly managed renminbi stablecoin might both exist or impede the persevering with US greenback world hegemony over the monetary system.

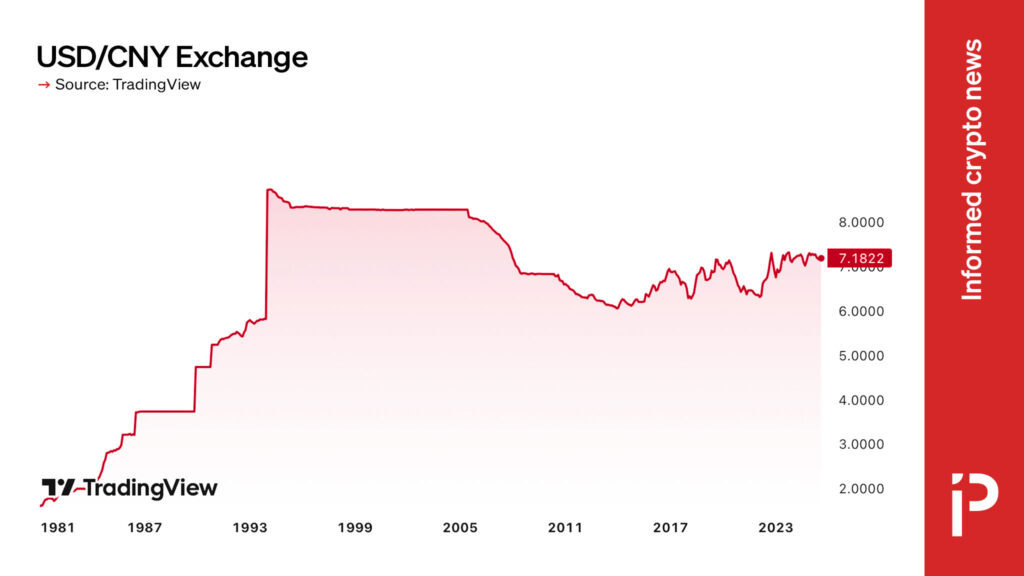

With out entering into the shortage of Chinese language central financial institution independence or how the yuan has been structured to maintain Chinese language exports low cost, the yuan is a bizarre foreign money. That is to say that there really exist two yuans: one for home use and one for offshore markets, and so they commerce at barely totally different values (as of writing, CNY, or home yuan, trades at 7.189 per US greenback, whereas the CHN, or offshore markets yuan, trades at 7.193 per US greenback).

Moreover, know your buyer and anti-money laundering legal guidelines have substantial penalties in China, and the renminbi can be utilized much more successfully to sanction people, corporations, or international locations than the US greenback as a result of nearly everybody strictly makes use of the yuan digitally, and the Individuals’s Financial institution of China can exert full management over any facet of the foreign money.

Whereas this allows the CCP to make sure a semblance of worth controls, it additionally has led to many Chinese language nationals attempting to find methods to exit the foreign money for extra helpful worldwide currencies just like the US greenback and euro, resulting in a major quantity of capital flight. China additionally has not seen any widespread use of the yuan outdoors of Mainland China, even with war-torn allies like Russia and Iran.

There’s already a Yuan stablecoin

For these acquainted with Tether, the biggest cryptocurrency firm on this planet and the stablecoin with the best market capitalization and most quantity, they could additionally bear in mind that in 2019 Tether issued an offshore yuan stablecoin.

Since then, the Chinese language nationwide who helped them create the stablecoin and discover some preliminary demand, Zhao Dong—often known as the OTC king in China as soon as upon a time—has been arrested and sentenced to years in jail. Nearly no extra Tether yuan has been minted for the reason that arrest.

This implies that not solely are there inherent points with the flexibility for Chinese language nationals and foreigners to make the most of Chinese language stablecoins, but it surely additionally proves there’s a powerful lack of demand for yuan-denominated stablecoins to start with.

Much less management or no demand

China faces a narrowing bridge that it should cross whereas it continues to make use of Hong Kong as a testbed for all of its stablecoin and cryptocurrency ventures: will it loosen worth and capital controls on its foreign money in order that anybody—from businessmen to vacationers to criminals—finds the yuan extra helpful, or will they see their far-reaching desires of a unified BRICS foreign money taking down the greenback evaporate into skinny air?

It seems as if a renminbi stablecoin could possibly be the primary take a look at in years for the Individuals’s Financial institution of China to both make the yuan a worldwide powerhouse vying with the US greenback in worldwide markets or one more instance of the CCP maintaining sturdy worth controls in place to make sure home complacency.