I feel the title makes it clear that this might be a rambling confused put up. I’m typing on with the thought that one thing is healthier than nothing and nobody has to learn this.

At present the ratio of the Case-Shiller housing value index to the CPI is increased than it was in 2006.

I don’t wish to jinx the financial system (my predictions are nearly all the time fallacious) however I’m not terrified. I feel that this time it’s totally different. This time there has additionally been an enormous improve in lease additionally relative to the quickly growing basic value degree. This means that prime housing costs are as a result of a real scarcity not hypothesis.

HIgh rents additionally imply that the worth of housing companies is excessive. Individuals paying a excessive down cost and really excessive mortgage funds because of the mixture of a excessive home value and excessive mortgage rates of interest have unatractive options. In econospeak the worth of the housing companies they acquire is excessive.

I rely extra on vibes than numbers (and I admit it). There aren’t the same old signs of a bubble which embody loads of discuss capital features, individuals explicitly shopping for planning to promote quickly for the next value (flip) individuals getting into the market who didn’t take part earlier than (the place right here the market is for second houses).

Additionally individuals complain concerning the excessive costs. A excessive value is unhealthy for the customer and good for the vendor, and likewise unhealthy for somebody who plans to purchase sooner or later and good for somebody who can promote. I learn concerning the complaints of determined consumers not the gloating of sellers.

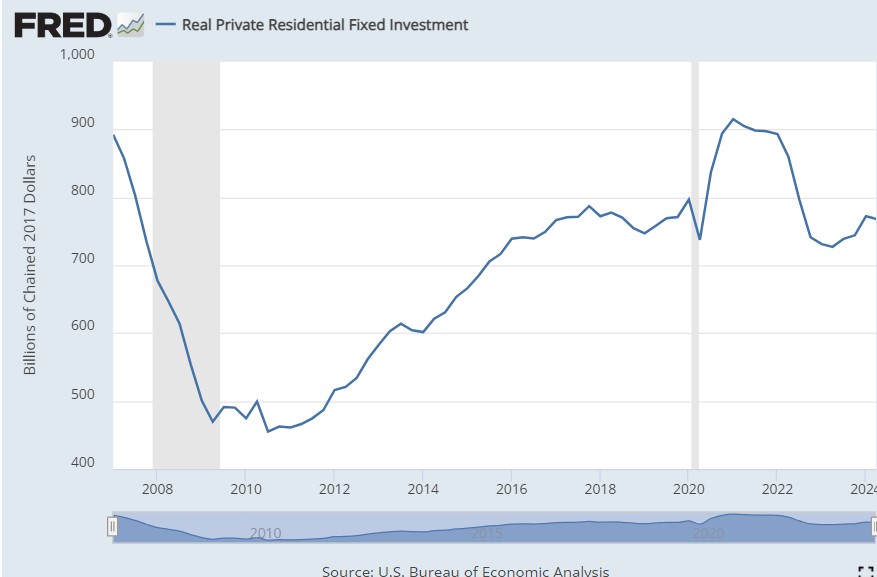

The excessive demand at excessive costs can be crucial proper now. It means residential funding has remained pretty excessive regardless of excessive rates of interest (together with the mortgage rate of interest which is the one what issues for housing demand).

This is essential. The primary methods by which financial coverage impacts the true financial system is thru residential funding which is low if rates of interest are excessive and thru change charges. Given the simultanious shift to tight anti-inflation coverage in wealthy international locations, the best way that the FED’s anti-inflation efforts would have an effect on actual GDP and employment is generally residential funding.

The third channel is funding in non-residentia buildings that are principally workplace constructing and buying malls (manufacturing unit buildings are giant however low-cost).

However wait, if excessive rates of interest didn’t have an effect on mixture demand, how did they trigger the dramatic decline in inflation? I feel they didn’t. I feel that prime inflation was as a result of Covid disruptions and never extraordinarily excessive mixture demand and that it declined though the housing scarcity triggered financial coverage to be ineffective.

That’s I comply with Krugman (as all the time — it’s actually embarrassing) and name the excessive inflation lengthy termporary – one thing that lasted years however was destined to fade away by itself.

Because of this I ascribe the FED’s comfortable touchdown triumph to pure luck.

It additionally signifies that I hope with some confidence that the touchdown might be comfortable

(RJW confidence is a really alarming main indicator – I’m nearly all the time fallacious).