Regardless of acquired knowledge being that Elon Musk is the world’s wealthiest individual, crypto merchants are all of the sudden doubting his skill to carry onto his title.

This week, Polymarket merchants had been putting bets at 96% odds that Musk would slip from prime spot. Those self same binary choices had been buying and selling at 15% odds as not too long ago as Tuesday.

In the meantime, on US-based Polymarket competitor Kalshi, related choices traded down from 91% to 64% inside 36 hours.

That dramatic transfer in betting for the world’s prime billionaire follows a world document in Musk’s private compensation.

Particularly, on September 5, Tesla’s board of administrators proposed $1 trillion in government compensation for Musk — the biggest proposed pay bundle in historical past by a minimum of two orders of magnitude.

Simply three enterprise days later, nonetheless, betting odds for him dropping his prime spot spiked 540% on Polymarket.

In accordance with the tremendous print on Polymarket’s decision metric for its binary choices contract, the reference for Musk’s private wealth is particularly Bloomberg’s Billionaires Index. On that webpage, the second wealthiest individual is Oracle’s Larry Ellison.

Kalshi, in distinction, makes use of Forbes’ estimates.

$1 billion distinction between world’s two richest males

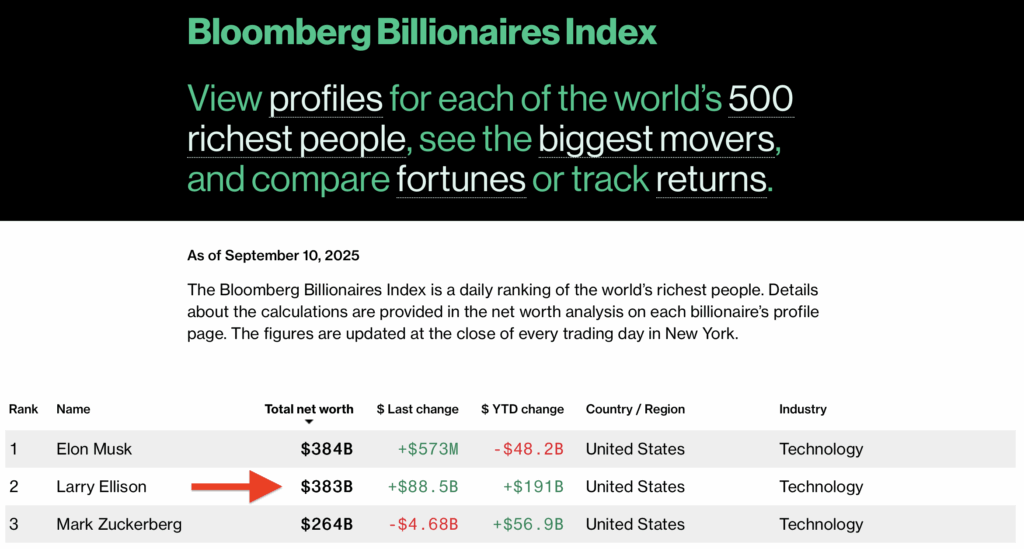

Curiously, Bloomberg’s estimate of Ellison’s internet price had jumped by a large $88.5 billion as of seven:28pm New York time yesterday.

Screenshot of Bloomberg Billionaires Index at 7:28pm New York time on September 11, 2025.

Screenshot of Bloomberg Billionaires Index at 7:28pm New York time on September 11, 2025.

This screenshot of Bloomberg’s rating reveals Musk barely forward of Ellison. Particularly, Bloomberg estimated Musk’s internet price at $384 billion and Ellison’s internet price at $383 billion.

A rounding error might have simply displaced Musk from the highest slot.

Certainly, if somebody was refreshing their browser persistently, it’s attainable that the webpage displayed Ellison within the #1 spot in some unspecified time in the future yesterday.

Furthermore, there are third–get together experiences that Ellison did surpass Musk because the world’s richest individual this week.

The decision description on Polymarket reads, “This market will resolve to Yes if Elon Musk is any rank other than #1 on the Bloomberg Billionaires Index at any point between June 30, and December 31, 2025, 11:59 PM ET.”

Given this language, it’s curious that the market continues to be accepting bets at solely 64% odds as of publication time.

Ellison beneficial properties whereas Musk loses floor

12 months so far, Bloomberg estimates Ellison has gained $191 billion whereas Musk has misplaced $48.2 billion.

Ellison’s greatest acquire occurred this week attributable to Oracle’s blockbuster earnings announcement.

Certainly, Oracle widespread inventory rallied 38% inside the previous three buying and selling days, including $238 billion to its market capitalization. As its largest shareholder, Ellison’s 40% fairness stake within the firm earned him a windfall this week that just about catapulted him atop the world’s wealth leaderboard.

As of publication time, betting strains have retraced a few of their gorgeous strikes. Polymarket merchants are actually betting at 64% odds and Kalshi at 68% odds that Elon stays the world’s wealthiest individual this yr.

In fact, neither Polymarket nor Kalshi’s prediction markets mirror the precise odds that any occasion will happen outdoors the blockchain. These exchanges merely facilitate bets from merchants who’re speculating on binary choices.

Though these platforms contain an information oracle for actual world enter, merchants might pay no matter worth they need — whether or not or not the chances price has something to do with the precise chance of the occasion occurring.

Ellison’s booming Oracle versus Musk’s dwindling Tesla

Musk derives nearly all of his internet price from Tesla fairness and his authorities contractor, SpaceX. His investments in X and xAI are linked to varied fairness offers with Tesla.

He additionally has smaller property like Neuralink and The Boring Firm.

Tesla has struggled this yr, dropping from a December excessive of $488 per share to its present worth of $368. 12 months so far, Tesla car gross sales have been declining, and Musk abruptly left his put up in Trump’s administration.

In the meantime, Oracle shares have soared 85% yr so far amid new offers for its cloud and AI divisions.