Whether or not it’s refining your small business mannequin, mastering new applied sciences, or discovering methods to capitalize on the following market surge, Inman Join New York will put together you to take daring steps ahead. The Subsequent Chapter is about to start. Be a part of it. Be part of us and 1000’s of actual property leaders Jan. 22-24, 2025.

That is the fourth installment of Inman’s Speaking Expertise sequence. For Half One, click on right here. For Half Two, click on right here. And for Half Three, click on right here.

With every part that has been occurring this yr — fee lawsuits, the DOJ, the tepid market, and so forth. — Redfin may not have been on a variety of radars this yr. But it surely ought to have been.

TAKE THE INMAN INTEL INDEX SURVEY FOR DECEMBER

Whereas a lot of the trade was coping with existential dread, Redfin made a serious pivot: Redfin Subsequent. This system, introduced late in 2023 however rolled out nationally in 2024, jettisoned Redfin’s previous wage mannequin for brokers and changed it with commissions. The transfer was explicitly a play to draw stronger expertise; whereas some corporations have turned to acquisitions or franchising or international enlargement to seek out expertise in these unsure occasions, Redfin selected a special path and reimagined considered one of its core differentiators.

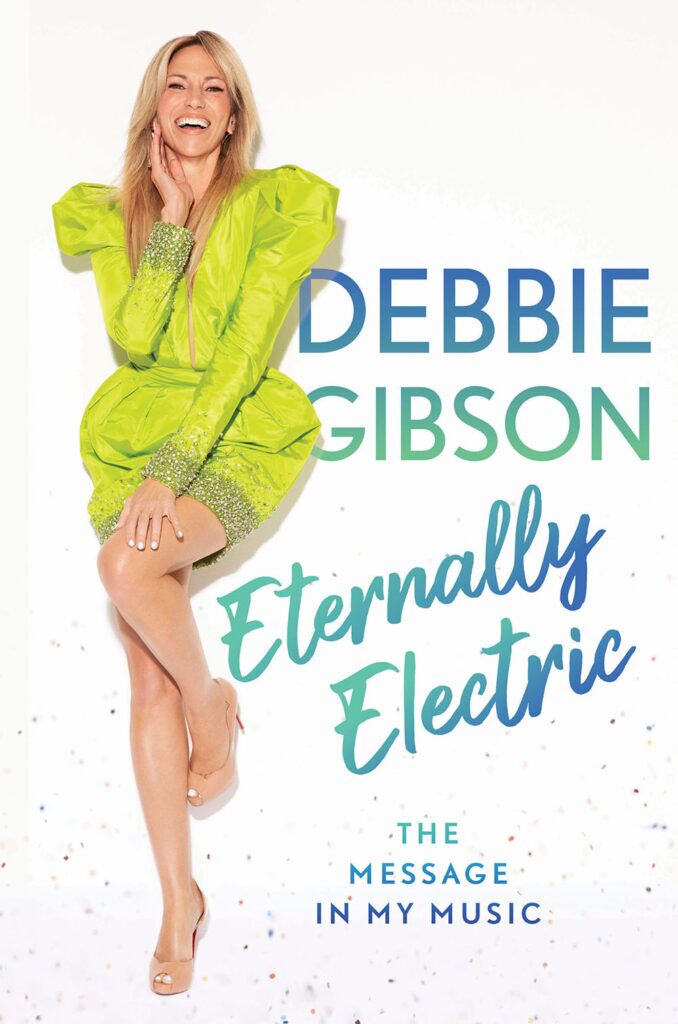

Jason Aleem

As a part of the Speaking Expertise sequence, Inman not too long ago caught up with Jason Aleem, Redfin’s chief of actual property companies. The dialog touched on Redfin Subsequent, and the way the corporate thinks about recruiting and retention at this second, amongst different issues.

And the takeaway from this dialog is that, based on Aleem, Redfin Subsequent’s fee mannequin is working. The corporate has introduced on a whole lot of brokers since launching this system, a few of them “boomerang agents” who beforehand labored at Redfin, and the brokers themselves are incomes more cash. In that gentle, Aleem described the transfer as clearly the fitting one for Redfin.

What follows is a model of Inman’s dialog with Aleem that has been edited for size and readability.

Inman: It has been a brand new sort of yr for Redfin with the pivot to the fee mannequin. Speak to me about how that’s going.

Jason Aleem: It’s been probably the most transformative issues we’ve ever executed for the corporate and for our clients. And it’s all constructed round us having the perfect brokers and having the ability to present the perfect buyer expertise.

Should you take a look at what we’ve executed to this point, we’re at about 1,800 brokers or so. We’ve made nearly 700 hires beneath this Subsequent program, which doesn’t sound like an enormous quantity in comparison with among the different brokerages. However we don’t want that many brokers to be a small however mighty crew. And that’s partly as a result of when you take a look at Actual Developments, the quantity of offers we do per agent is a lot bigger than the competitors. So we’ve been capable of workers fairly aggressively by means of Subsequent.

What number of markets has this mannequin rolled out in?

We did this in 4 waves. It’s now in all Redfin markets. So we kicked it off in 4 markets and shortly noticed that that is precisely what’s good for purchasers as a result of we noticed an enchancment in our shut fee. And that’s how many individuals come and meet with us and resolve to really work with us. After which we noticed extra brokers that have been a lot happier as a result of they have been beginning to earn more money.

Then we began to see a special mixture of brokers and expertise being drawn to the enterprise. So we shortly scaled from 4 markets in January to being nationwide as of the tip of October.

We noticed a bit of little bit of attrition, which is to be anticipated with a giant transition like this. However the overwhelming majority of our prime brokers stayed. The wonderful factor is we began to see a variety of what we name boomerang brokers return to the corporate as a result of they’ve seen that this plan actually works.

As this transition has rolled out, have the kind of transactions your brokers are dealing with modified? For instance, are your brokers doing roughly luxurious? Is the everyday Redfin deal totally different now?

Many of the offers are the identical.

We didn’t change a ton with regard to how we generate demand. However I might say that a variety of the expertise that we’re attracting, they drive a variety of loyalty enterprise that’s in larger value factors. And that has led us to doing extra luxurious as a result of they carry a few of that enterprise with them.

The opposite factor I might say is that a variety of the individuals who have joined are simply higher in a few of these totally different high-end areas. So we’re taking good care of that luxurious clientele higher than what we did earlier than.

Is the common Redfin agent incomes extra at this time than they have been a yr in the past?

Should you take a look at our wave one markets, which have been mainly Southern California and San Francisco — so LA, Orange County, San Diego, San Francisco — the people who find themselves in these markets are making about 25 % extra this yr than what they did the yr earlier than.

After which when you go to our wave two bucket — which is Chicago, Dallas, Miami, New York, Palm Seashore and, I believe, D.C. and Connecticut — they’re making about 20 % greater than what they did the yr earlier than. And that’s on common in each of these locations. However you do have some individuals in these markets who’re completely crushing it.

We set a aim the place we wished to have our first million-dollar producer who truly took dwelling one million bucks. And we did that. We made it occur in Orange County.

Then we additionally had an agent in our Chicago market who ended up doing like 1 / 4 million bucks of their first three months on this new plan. So in terms of growing compensation yr over yr, it’s fairly clear that that is the plan.

You talked about boomerang brokers. Do you will have any numbers on what number of people have been at Redfin, left, after which returned?

So one of many issues I’ve been most enthusiastic about are the boomerang brokers. These are the oldsters who know Redfin, know Redfin tradition, know Redfin methods, know Redfin management, and for no matter cause determined to go away and check out one thing else out. And that’s nice. Then they heard about this new plan and mentioned, you understand what, that is the perfect of each worlds.

Out of that just about 700 brokers that I discussed earlier, about 13 % of them are boomerang brokers.

Are you going out and actively headhunting, or are the general public who be part of Redfin searching for you out?

Each.

Previously, we have been way more of a passive recruiting crew the place lots of people sought us out.

However we’ve a brand new mantra and it’s “sales leaders are recruiters.” And a variety of our gross sales leaders who had principally been targeted on simply managing the crew, ensuring the shopper is effectively taken care of, we’ve pivoted a big portion of their time to constructing their crew through recruiting and retention.

So our gross sales leaders who’re closest to the enterprise are actually engaged within the course of. So when you take a look at the combination, we’ve a wholesome combine of recent expertise that’s coming as a result of an present agent referred them.

This yr has been arguably probably the most tumultuous for actual property ever with all of the fee lawsuits. As you’ve talked to brokers in the course of the recruiting course of, what are they saying?

There have been tectonic shifts this yr. We need to have these conversations with individuals. And it’s top-of-the-line issues about having gross sales leaders as recruiters is that there are actual conversations occurring on the bottom with actually knowledgeable individuals.

Relating to issues like NAR, we actually attempt to take the strategy, going again to our values of transparency and our technique of ease and being on demand, the place we make it straightforward to get out to see at dwelling. However we additionally wished to ensure we stayed utterly above board and compliant.

So we’ve our charge settlement, the place it’s tremendous straightforward for individuals to get into a house, however we’re additionally capable of abide by the foundations. That’s attracted expertise. There was expertise who stick with us as a result of it means they’re going to get extra at-bats.

Our stance on Clear Cooperation is wanting to ensure {the marketplace} stays open and that we’re taking good care of clients and sellers in the fitting method. That has been one which our brokers have discovered enticing.

You talked about NAR. Redfin itself left NAR, however I’m curious concerning the brokers themselves. Are most Redfin brokers nonetheless members?

Most brokers are nonetheless members. Should you do the analysis it’s fairly darn onerous to extract your self from that group as a result of, operationally, so many components of the enterprise are depending on entry to info or entry to types or cooperation.

We nonetheless have our identical stances on among the issues that want to vary with NAR. However on the finish of the day, we have to maintain clients and brokers. So we’re ensuring that we’re being considerate about how we extricate ourselves from that scenario.

What’s your message for brokers and brokers proper now?

Give us a name. Let’s speak. The world’s altering.

I do suppose that there might be increasingly more consolidation within the area. If you wish to go to a spot the place you may one hundred pc deal with the shopper and the issues that you simply do finest, it’s best to give us a name as a result of we laid out a bunch of straightforward buttons for brokers to have the ability to pop in and do what they do finest.

Jim Dalrymple II