Tax adjustments introduced within the funds might have “devastating, unintended consequences” on stay music venues, together with widespread closures and job losses, commerce our bodies have warned.

The our bodies, representing practically 1,000 stay music venues, together with grassroots websites in addition to arenas such because the OVO Wembley Area, The O2, and Co-op Reside, are calling for an pressing rethink on the chancellor’s adjustments to the enterprise charges system.

If not, they warn that tons of of venues might shut, ticket costs might improve, and 1000’s might lose their jobs throughout the nation.

Politics newest: Ex-Olympic swimmer nominated for peerages

Enterprise charges, that are a tax on industrial properties in England and Wales, are calculated by a posh formulation of the worth of the property, assessed by a authorities company each three years. That’s then mixed with a nationwide “multiplier” set by the Treasury, giving a remaining money quantity.

The chancellor declared in her funds speech that though she is eradicating the enterprise charges low cost for small hospitality companies, they might profit from “permanently lower tax rates”. The burden, she mentioned, would as an alternative be shifted onto massive firms with large areas, resembling Amazon.

However each small and huge firms have seen the assessed values of their properties shoot up, which greater than wipes out any low cost on the tax charge for small companies, and can see the payments of area areas improve dramatically.

Within the letter, coordinated by Reside, the commerce our bodies write that the impact of Rachel Reeves’s adjustments are “chilling”, saying: “Hundreds of grassroots music venues will close in the coming years as revaluations drive costs up. This will deprive communities of valuable cultural spaces and limit the UK creative sector’s potential. These venues are where artists like Ed Sheeran began their career.

“Ticket costs for customers attending area reveals will improve because the dramatic rise in area’s tax prices will seemingly trickle by to ticket costs, undermining the federal government’s personal efforts to fight the price of residing disaster. Many of those arenas are seeing 100%+ will increase of their enterprise charges legal responsibility.

“Smaller arenas in towns and cities across the UK will teeter on the edge of closure, potentially resulting in thousands of jobs losses and hollowing out the cultural spaces that keep places thriving.”

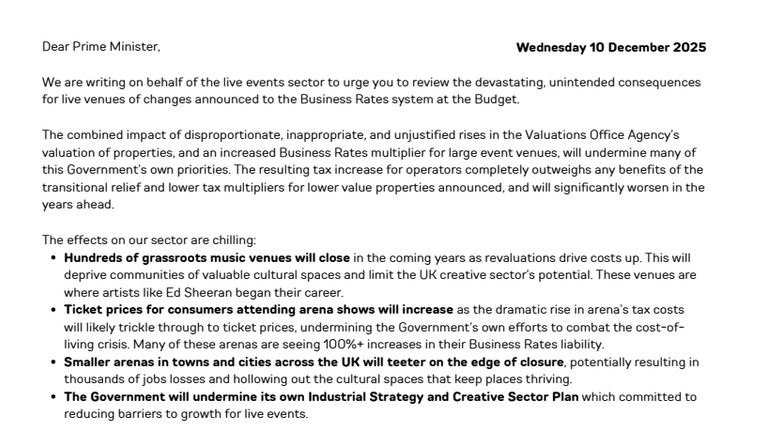

Picture:

The complete letter from commerce our bodies to the prime minister.

They go on to warn that the federal government will “undermine its own Industrial Strategy and Creative Sector Plan which committed to reducing barriers to growth for live events”, and also will scale back spending in accommodations, bars, eating places and different excessive avenue companies throughout the nation.

To mitigate the influence of the tax adjustments, they’re calling for a direct 40% low cost on enterprise charges for stay venues, consistent with movie studios, in addition to “fundamental reform” to the system used to worth industrial properties within the UK, and a “rapid inquiry” into how occasions areas are valued.

2:38

Sky’s Jess Sharp explains how the funds might influence your cash

“For the music sector, we are also relaxing temporary admission rules to cut the cost of bringing in equipment for gigs, providing 40% orchestra tax relief for live concerts, and investing up to £10m to support venues and live music.”

The warning from the stay music business comes after small retail, hospitality and leisure companies warned of the potential for widespread closures because of the adjustments to the enterprise charges system.

5:15

Sky’s political editor Beth Rigby challenged Prime Minister Sir Keir Starmer on the tax rises within the funds.

Evaluation by UK Hospitality, the commerce physique that represents hospitality companies, has discovered that over the subsequent three years, the common pub pays an additional £12,900 in enterprise charges, even with the transitional preparations, whereas a mean lodge will see its invoice soar by £205,200.

A Treasury spokesperson mentioned their cap for small companies will see “a typical independent pub pay around £4,800 less next year than they otherwise would have”.

“This comes on top of cutting licensing costs to help more venues offer pavement drinks and al fresco dining, maintaining our cut to alcohol duty on draught pints, and capping corporation tax,” they added.