Australian and worldwide expertise firms are amongst greater than 1,200 organisations which didn’t pay tax within the 2022-23 monetary 12 months, based on an Australian Taxation Workplace (ATO) report.

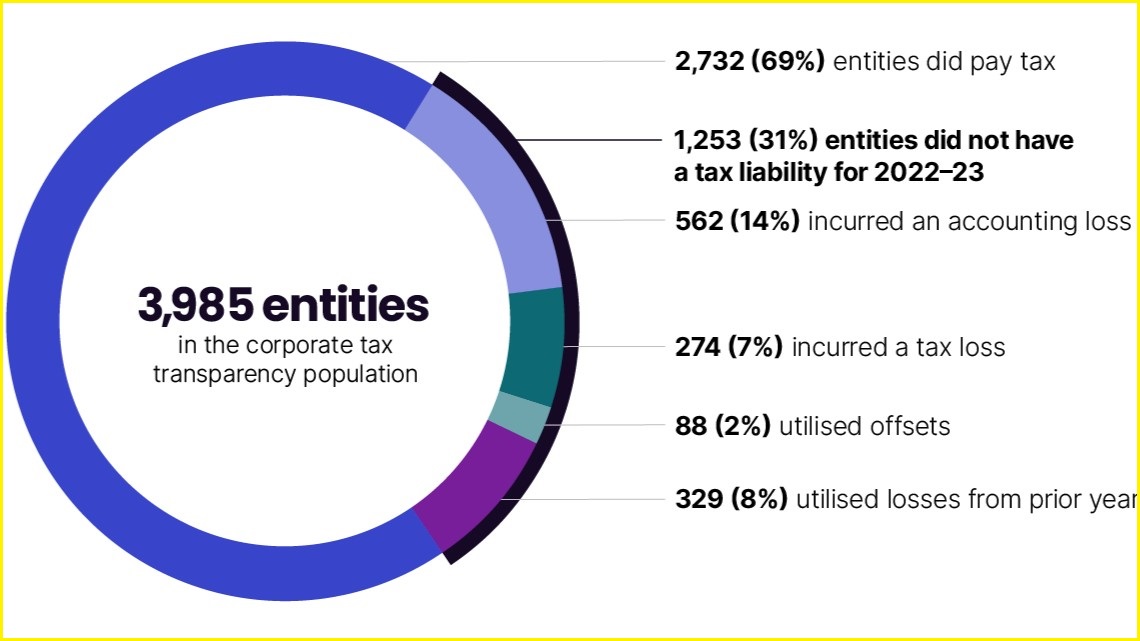

The ATO’s tenth company tax transparency report, launched final Friday, confirmed round 30% of the three,985 entities that lodged tax returns for 2022–23 didn’t pay any tax in Australia that 12 months.

Massive names in expertise which didn’t pay tax for 2022-23 included TPG Telecom (on earnings of just about $5.9 billion), Sony Australia (which earned greater than $1.5 billion), Netflix Australia (which made greater than $1.1 billion), and Australian design big Canva (which reported greater than $1.4 billion in earnings and $69.9m in taxable earnings).

Smaller names which paid no tax in 2022-23 included cyber safety firms CyberCX, Development Micro, and Tesserant; IT firm Datacom; telecommunications firm Superloop; fintech agency Zip Co; and Chinese language big Huawei Applied sciences.

Search the total listing of entities from the ATO report under.

ATO deputy commissioner Rebecca Saint instructed ABC Information that the company had “issues with the tech sector”, however in a press launch mentioned the ATO had seen continued “enchancment within the tax compliance of enormous companies” because it labored to stop tax avoidance.

“While there are legitimate reasons why a company may pay no income tax, the Australian community can be assured we pay close attention to those who pay no income tax to ensure that they are not trying to game the system,” she mentioned.

Assistant Treasurer Stephen Jones instructed ABC Information on Friday that figuring out multinational tax avoidance was a “huge priority for the government”, however some companies rightly didn’t at all times pay tax.

“There’ll be some of those businesses who aren’t paying tax because they’re not making any money, they’re breaking even, or they’ve made a huge capital investment and any money they have made is being offset against the capital investments that they’ve made,” he mentioned.

“So, a few of that’s indicators of wholesome financial exercise, significantly if there’s been an enormous capital funding — we would like that, it’s going to drive productiveness.

“But if it’s avoidance, we’re onto it.”

This ATO graph reveals what number of entities did (and didn’t) pay tax in 2022-23. Picture: ATO / Equipped

Massive Tech’s earnings minimisation

The proportion of organisations that paid no earnings tax has dropped from 36% within the ATO’s first company tax transparency report (2013-14) to 31% in 2022-23.

Nevertheless, main expertise firms have typically claimed that solely very small quantities of their earnings in Australia are taxable, and have used refined accounting to minimise what they owed underneath Australia’s 30% company tax charge.

Microsoft’s native information centre enterprise paid no tax in 2022-23 on $1.1 billion of earnings, whereas the corporate’s important Australian arm paid greater than $118 million in tax on $7.5 billion in earnings, virtually $400 million of which was taxable.

Apple paid virtually $142 million in tax in 2022-23 after raking in additional than $12 billion in earnings in Australia — solely $481 million (or round 4%) of which was reported as taxable.

Fb Australia paid virtually $38 million in tax on virtually $1.3 billion of earnings in the identical 12 months, whereas Google Australia paid $124 million on $2 billion in earnings and its Google Cloud arm paid virtually $9 million on $158 million in earnings.

Samsung Electronics Australia paid greater than $38 million in tax in 2022-23 after making virtually $3.4 billion in native earnings.

A complete of $97.9 billion in earnings tax was paid by massive firms for the 2022-23 monetary 12 months, up 16.7% from the earlier 12 months and the biggest quantity since reporting started, the ATO mentioned.

The rise was partly as a consequence of greater income from mining, oil, and fuel firms.

“Tax paid by the oil and gas sector increased to $11.6 billion in 2022–23, with some oil and gas companies now amongst the largest taxpayers in Australia,” Saint mentioned.

“This result was driven by a combination of commodity prices, the project production life cycle, and ATO intervention.”

The information confirmed that for a second 12 months in a row, the mining sector paid extra tax than all different sectors mixed.

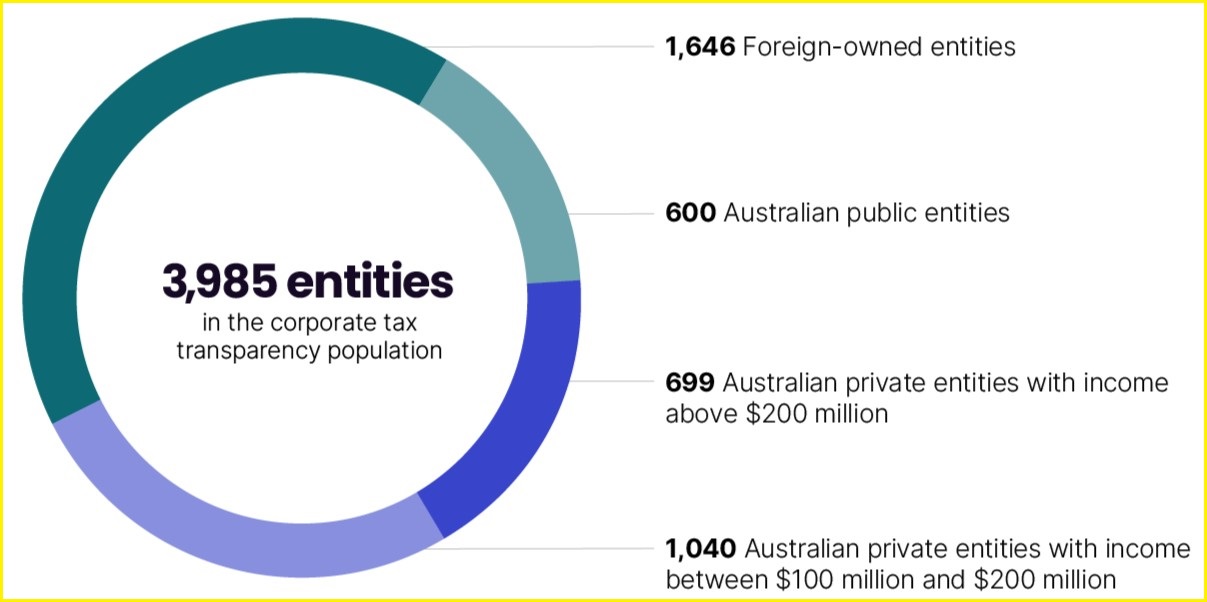

This ATO graph reveals company entities by their possession phase in 2022-23. Picture: ATO / Equipped

ATO’s AI-based tax cheats plan

The ATO outlined final week the way it makes use of synthetic intelligence applied sciences to enhance its processes and crack down on tax avoidance.

In a submission to a parliamentary inquiry into the usage of AI methods by the general public sector on 25 October, the company mentioned it used AI “to review large quantities of unstructured data, generate risk models to identify potential non-compliance, provide real time prompts to taxpayers and draft and edit communications”.

In a single instance, pure language processing had been used to course of 36 million paperwork and determine “entities of interest and their relationships”, the ATO mentioned.

“Since 2016, this initiative helped raise more than $256 million in liabilities and collect over $65 million in cash as of September 2024,” it mentioned.

AI was used to ship real-time prompts to taxpayers once they had been finishing their tax returns by way of MyTax and will determine taxpayers who had funds due however had been “unlikely to pay on time”, the ATO mentioned.

The company mentioned AI was additionally used for fraud safety, matching info submitted by taxpayers, and figuring out “high risk work-related expense claims that warrant a request for substantiation”.

This story first appeared on Info Age. You’ll be able to learn the authentic right here.