The speed of inflation might have eased barely however it’s clear that UK households are dealing with a surge of rising prices forward.

At an annual fee of two.5%, the patron costs index (CPI) measure of inflation for the 12 months to December is nicely under the energy-led value of dwelling disaster peak above 11%.

Whereas that’s clearly a aid, costs are nonetheless usually rising – simply not as rapidly.

Cash newest: Response to inflation knowledge amid warnings of rises forward

Some rising payments forward that we all know of might be inflationary whereas others might be – it is simply too early to know given uncertainty hanging over the prospects for contemporary Financial institution of England rate of interest cuts and the consequences of finances tax measures on employers from April.

Market jitters over the impression of Donald Trump’s return to the White Home, which in flip have intensified scrutiny and stress on the UK’s public funds, add to an advanced image for the worth outlook.

So the place are the upwards pressures on prices within the UK all coming from? Listed below are 10 areas the place they’re doubtless, if not sure.

All over the place?

It is an unashamedly broad brush but it surely’s necessary to recognise the truth that enterprise foyer teams have broadly warned of a worth punishment because the finances, which put companies on the hook for £25bn of tax rises introduced by chancellor Rachel Reeves.

It signifies that from April, when measures resembling increased employer nationwide insurance coverage contributions take impact, any enterprise dealing with the next tax invoice might probably pile that further value on to their prospects.

0:29

What is the outlook for grocery prices?

In retailers

With regards to the topic of passing on finances tax hikes, retailers have been probably the most express about it.

That’s as a result of the likes of grocery store chains are among the many nation’s greatest employers, with Tesco alone anticipating a £250m hit per 12 months over 4 years, amounting to £1bn.

The British Retail Consortium has warned of meals costs going up, rising by an annual fee of 4.2% by the 12 months’s finish, whereas two-thirds of high bosses throughout the retail business as a complete are planning to lift costs.

At banks and lenders

Even after as we speak’s inflation knowledge, monetary markets are nonetheless solely pricing in two rate of interest cuts over the 12 months up to now primarily as a result of inflation is forecast to rise within the months forward.

Evaluation by Pantheon Macroeconomics on Wednesday forecast a determine of three.2% in April.

Increased borrowing prices to assist hold a lid on inflation imply elevated mortgage charges, in a 12 months that’s anticipated to see hundreds of thousands of households search a brand new fastened deal.

There’s additionally a threat the current market turmoil, that has seen UK authorities long-term borrowing prices soar to ranges not seen since 1998, pushes mortgage prices even increased.

Any rises in so-called swap charges, which decide the price of financing dwelling loans for banks, are sometimes handed on to the borrower.

On imports

A weaker pound – as just lately witnessed in the course of the market troubles – makes the price of importing items costlier.

Sterling is presently 12 cents down on the place it stood towards the greenback on the finish of September whereas it’s greater than two cents down on the euro.

The divergence within the falls tells you that the majority of the pound’s issues are extra tied to greenback power than pound weak spot.

It may be defined by the truth that traders are fearful concerning the impression of common commerce tariffs threatened by Mr Trump pushing up home inflation within the US.

Gasoline payments

The stress on the pound as a part of the aforementioned market occasion signifies that a double whammy for gasoline payments is imminent.

A weaker pound, coupled with an increase in world oil prices that are priced in {dollars}, signifies that drivers are dealing with the prospect of additional will increase on the pumps past the 3p-a-litre seen since Christmas.

Brent crude oil is presently standing at $80 a barrel – up from $71 only a month in the past.

Vitality

Vitality payments have been on the rise since October when a ten% enhance within the power worth cap took impact.

Whereas typical payments have been up by an extra 1% in January, additional will increase in wholesale costs in current months are anticipated to be mirrored within the cap from April.

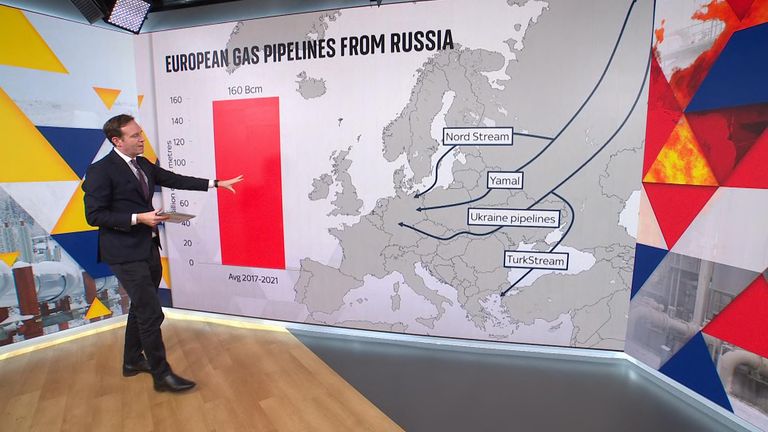

The newest forecast by business consultants Cornwall Perception noticed a 3% hike from April to a mean £1,785, although current chilly snaps throughout Europe, coupled with weak storage ranges, have pushed up pure fuel contracts since.

Benchmark British fuel costs rose by 20% in the course of the second half of December as colder climate led to increased demand throughout Europe. Weaker inventories will even imply that storage needs to be replenished at the next value than seen after the earlier, delicate winter.

5:30

Why your power payments look set to rise

Water

It was introduced simply earlier than Christmas that the common annual water invoice throughout England and Wales was to rise by 36% over the subsequent 5 years.

Simply how a lot depends upon the place you reside because the hikes fluctuate by provider. Southern Water prospects face the heftiest will increase from April by means of a 53% enhance to £642 by 2030.

2:31

Water payments ‘an absolute shame’

Council tax

Native authorities in England will be capable of increase core council tax by as much as 3% and the grownup social care aspect by 2% within the coming monetary 12 months.

No remaining choices have been taken throughout native authorities in Wales. In Scotland, the place the invoice contains water charges, rises of as much as 10% are being thought of by some councils after a few years of frozen payments.

Cell phones and broadband

Most prospects are on plans which have hyperlinks to December’s inflation fee.

Evaluation by worth comparability service uSwitch confirmed that cellular customers confronted common will increase of £15.90 a 12 months from April whereas broadband payments would go up by a typical £21.99.

It is value noting, at this level, that the communications regulator has banned contracts linked to the speed of inflation in favour of a set worth enhance to bolster transparency.

This utilized to new contracts from January.

What about my capacity to soak up worth rises?

The difficulty is, that has accomplished little to make households really feel higher off in what’s an evolving value of dwelling disaster.