The founders of now-collapsed Lithuanian crypto venture Bankera (BNK) used funds from its much-hyped preliminary coin providing (ICO) to purchase up luxurious actual property, together with a villa on the French Riviera and high-end property in Lithuania, leaving unfortunate traders a collective €100 million ($113.7 million) out of pocket.

That is based on a joint investigation by the Organized Crime and Corruption Reporting Venture (OCCRP) and Lithuanian outlet 15min.

Bankera’s founders Vytautas Karalevičius, Justas Dobiliauskas, and Mantas Mockevičius raised the funds from greater than 100,000 traders throughout the 2017 ICO, promising to create “a bank for the blockchain era.”

Nonetheless, based on the OCCRP, as an alternative of constructing the promised blockchain-powered financial institution, the founders seem to have funneled tens of millions into an in depth actual property portfolio by way of an online of corporations and a privately owned Pacific island financial institution.

The ICO proceeds, initially meant to develop cryptocurrency infrastructure and banking companies, had been reportedly used to again a collection of opaque loans, a lot of which had been routed by Pacific Personal Financial institution (PPB) in Vanuatu — a financial institution the trio quietly acquired close to the tip of the ICO.

Properties reportedly bought embrace a €1.1 million ($1.25 million) villa in Èze, France; a number of properties in Vilnius, Lithuania; and a beachfront resort in Vanuatu.

The transactions had been facilitated utilizing accounts in PPB, the place leaked financial institution information present over €45 million ($51 million) was transferred from Lithuania-based Bankera ecosystem corporations.

The ICO occurred between August 2017 and early 2018, peaking throughout the international crypto growth. Within the years that adopted, the BNK token collapsed in worth, whereas weekly payouts to traders — a key characteristic marketed within the white paper — additionally dwindled and had been ultimately halted in 2022.

By 2025, the token’s whole market capitalization had plummeted to about $1 million.

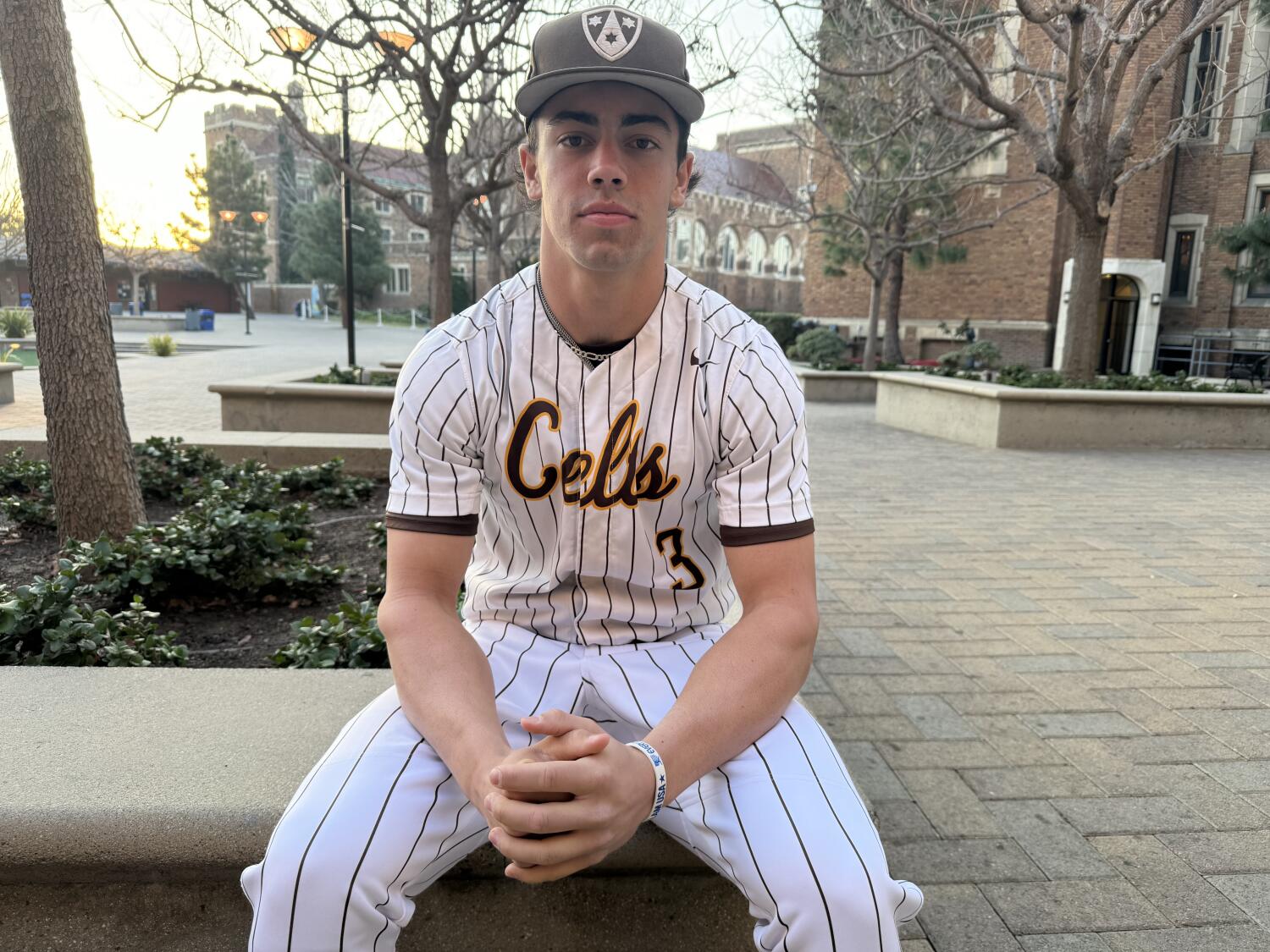

Picture courtesy of James O’Brien/OCCRP

Kathryn Westmore, a monetary crime professional on the Royal United Providers Institute, advised reporters, “To extract funds and seemingly use them to finance personal spending raises suspicions that investors have been misled and [the co-founders] have profited personally.”

She additionally claimed that the rash of ICOs in 2017 and 2018 was “the epitome of the wild west of crypto,” and added that folks dealing with losses from crypto investments usually miss out on compensation, due partly to the dearth of oversight of the sector.

Regardless of a number of makes an attempt by reporters to contact Bankera’s founders, no direct response was obtained by the OCCRP. Legal professionals for Bankera UAB, certainly one of a number of entities within the “Bankera ecosystem,” denied any wrongdoing and claimed that the PPB acquisition was a part of a broader technique to construct a blockchain-powered neobank.

Additionally they acknowledged the token’s decline however insisted that the model stays profitable.

The Central Financial institution of Lithuania has confirmed it referred the case to legislation enforcement however declined to reveal additional particulars. In the meantime, the founders proceed to seem at cryptocurrency conferences and preserve energetic roles in Lithuania’s fintech scene.

Whereas Bankera’s web site nonetheless advertises a “modern bank account alternative,” it has didn’t safe a European Union banking license seven years after its launch.