On Monday, Michael Saylor introduced the IPO of his fourth collection of most well-liked shares providing perpetual yield, Stretch (STRC).

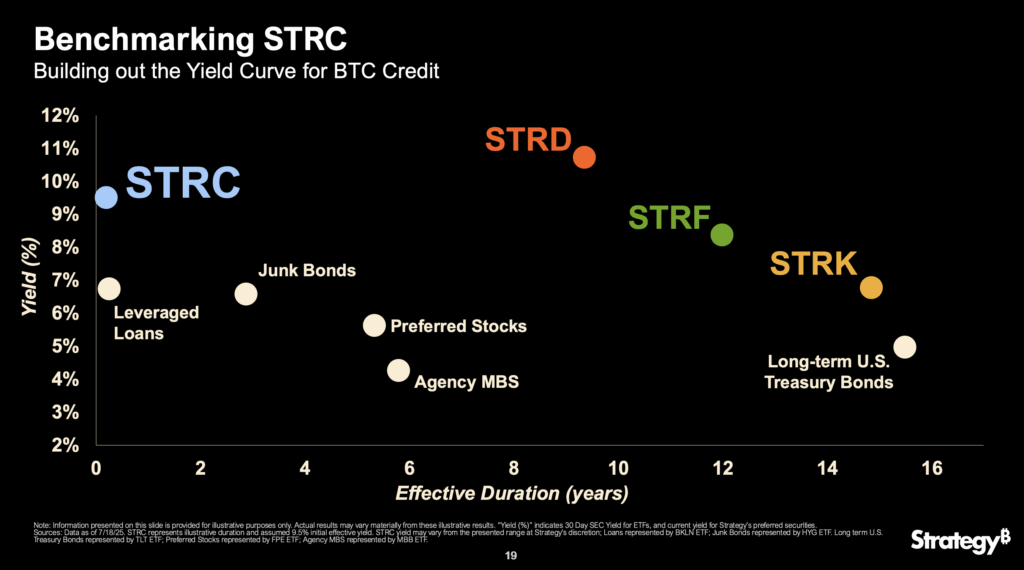

With its debut, Saylor claims that he’s “building out the yield curve for BTC credit” and has revealed the world’s first curvature of bitcoin (BTC) credit score for the world to behold.

As founding father of the world’s largest publicly traded BTC treasury firm, Saylor is exclusive in his capacity to challenge yield-bearing securities whereas holding over 3% of the circulating provide of BTC.

This privilege, in response to Saylor, permits his firm to benchmark its charges towards the yield curve of multi-trillion greenback bond markets like company mortgage-backed securities, junk bonds, and even US Treasuries.

Certainly, in response to a diagram revealed yesterday alongside the STRC IPO announcement, the supposed BTC credit score yield that MicroStrategy is constructing resembles the yield curve of those large devices plus a slight premium as a result of MicroStrategy’s idiosyncratic dangers.

Slide 19 of Technique’s July 21, 2025 STRC IPO Investor Presentation

Slide 19 of Technique’s July 21, 2025 STRC IPO Investor Presentation

Particularly, in response to Saylor, buyers are pricing Strife (STRF) — one other of MicroStrategy’s dividend-yielding most well-liked shares — at a “340 basis point credit spread above the 20-year Treasury bond.”

In different phrases, for simply an additional 3.4% yield, buyers are allegedly prepared to forego the complete religion and credit score of the US authorities for certainly one of MicroStrategy’s preferreds.

Bitcoin doesn’t have a yield curve

An precise credit score yield curve is a graph of yield percentages (rates of interest, displayed as percentages) and the maturity lengths of bonds with comparable credit score high quality.

For many collection of presidency or high-grade company bonds, yields curve upward.

A constructive, up-and-to-the-right slope is regular. Longer-duration bonds yield greater than shorter-term bonds as a result of buyers demand extra compensation for better uncertainty tied to time.

In line with Saylor, MicroStrategy’s BTC credit score yield curve is barely inverted — down and to the appropriate — as a result of it displays the truth of yields obtainable in in the present day’s market.

Brief-term junk bonds and leveraged loans, however, supply common yields of 6-7% % in the present day, whereas long-term US Treasuries supply yields of simply 4.9%.

In fact, the issue with Saylor’s so-called yield curve is that it graphs the yields of various devices. A yield curve ought to have a constructive slope in regular market circumstances as a result of the one variable that modifications is time — not time plus the instrument itself.

As well as, Saylor’s yield curve doesn’t graph bond yields in any respect. As a substitute, it graphs dividend charges from most well-liked shares which are junior to precise bonds in seniority.

Saylor conveniently excluded the precise bond yields that MicroStrategy has issued from his supposed BTC credit score graph.

$STRC is $MSTR’s stealth weapon.

Whereas others promote inventory to outlive, Saylor launches 1-month paper to print fiat → purchase BTC → increase NAV — all whereas retaining fairness tight.

This isn’t leverage.It’s a Bitcoin yield curve in disguise.

Hyperbullish. 🟧📊 pic.twitter.com/rpTKSr6tC0

— financialconspirator (@financialcnspr) July 22, 2025

Hyperbullish on a “bitcoin yield curve in disguise.”

Furthermore, MicroStrategy’s yield curve is just not the yield curve of BTC credit score in any respect. The truth is, BTC has no yield, nor does BTC supply any type of credit score.

BTC is solely an asset that transacts on a blockchain. Calling 4 most well-liked shares of an organization “the yield curve for BTC credit” is aspirational and complicated.

On the capital stack, STRC is senior to Stride, Strike and MicroStrategy (MSTR) frequent inventory. It’s junior to Strife and the corporate’s debt, together with six collection of convertible notes.